Equities Market

FINSEC provides an automated platform for the issuance, listing, trading and settlement of equity instruments. These instruments can be issued and traded privately or through public platforms.

Primary Market

Initial Public Offer (IPO)

This is a public offering in which shares of a company are sold to the public. It involves the production and publication of a prospectus, which must be approved by both FINSEC and the Securities and Exchange Commission of Zimbabwe. The prospectus will contain details of the company’s management, products/services, operations and both historical and projected financials.

Private Placement

This is when securities/shares in a company are offered to prospective shareholders through private arrangements. This listing method involves issuance of additional shares to raise capital.

Secondary Market

Listing by Introduction (LBI) allows a company to apply for listing without the conduct of an initial public offering (IPO) prior to the initial listing of the company’s securities on FINSEC. It applies to an application for listing of securities that are already issued or securities that will be issued upon listing, where no public offering will be undertaken.

When a company chooses to list by introduction, a pre-listing statement shall be published. This pre-listing statement is not an invitation to potential investors to subscribe for shares in the company, but is issued for the purposes of providing information to the public about the company. Investors will be able to buy shares in the secondary market trading of the company after the listing.

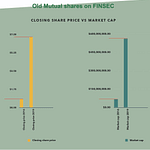

Listing by introduction on FINSEC helps to facilitate price discovery and market-value realisation, for Over-the-Counter traded and similar securities. Through market demand and supply forces together with an efficient information processing mechanism, buyers and sellers of securities listed on FINSEC are assured of transacting at fair prices.

When a company initiates the IPO process, a very specific set of events leading to the listing on FINSEC occurs. These events are usually undertaken through the guidance of the company’s Nominated Advisors who will coordinate meetings involving the various parties to the listing transaction. Other parties involved may include the Sponsoring Broker, Transfer Secretary, Independent Financial Advisor and Legal Advisor.

Resources

ATP Investor Application Form (Individuals)

Download NowATP Investor Application Form (Institutional)

Download Now

The FINSEC Private Markets is a market place that brings together private companies and investors seeking alternative investment opportunities. Using a digital platform, GEM Portal, the FINSEC Private Markets connects enterprises to Qualified Institutional Investors (QII) and High Networth Individuals (HNI) through automated screening, pipeline building, value discovery, funding and offers investors a smooth exit mechanism.

Business entities will qualify for Debt Financing, Equity financing (Public and or Private) Outright business sale.

The waiting time depends on your speed of completing the application.

The portal comes with a robust credit scoring model which provides the necessary sell-side information required to make an informed investing decision.

Your role will be to receive incoming applications with analysis, assist applicants in complying with ongoing obligations as set by the funders/ investors and recommend applications to investors.

Your role will be to receive analyst recommended applications, select applicants for further analysis based on investment criteria of your choice and ultimately provide funding for the applicants.

No. The system uses a robust rating and scoring model which leverages on data provided by the applicant.

Go to the website using the following link: www.finsec.co.zw/private-markets/